A journal is a book of original entries in which transactions are recorded, as and when they occur. The journal provides data-wise records of all the transactions and the amount of each transaction. Everyday transactions are recorded in a journal chronologically, giving a complete picture of the transaction in one entry.

Financial Accounting

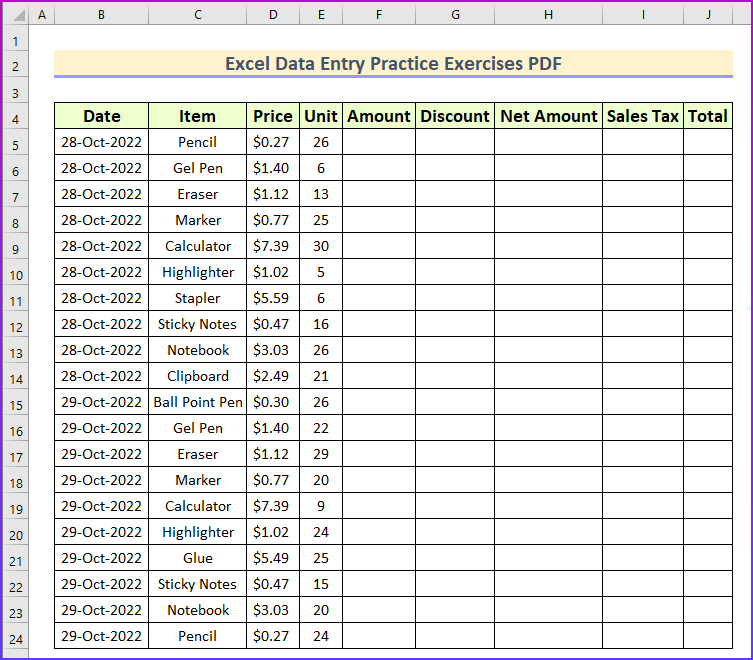

Remember that accounting skills require mastery of concepts and practice. All transactions are assumed and simplified for illustration purposes. For account titles, we will be using the chart of accounts presented in an earlier lesson. Paid for the computer equipment purchased above. Paid $4,000 for salaries to employees who worked this month. Rented warehouse space, $5,000 was paid for this month and $10,000 was paid for the following 2 months.

Connect & Improve AccountingOptional

Accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less $500 debit in the above transaction). The numbers come from the journal entries. Amounts on the left were debits to cash. Amounts on the right were credits to cash. D. Issuing stock to investors increases cash, recorded with a debit, and increases common stock, recorded with a credit.

Journal Entry Questions and Solutions

B. Using up the asset prepaid rent is an expense. An increase to an expense is recorded with a debit. Using an asset is also a decrease to the asset which is recorded with a credit. C. Wages paid to employees who worked this period is an increase to an expense and a decrease to cash. Increasing an expense is a debit and decreasing cash, an asset, is a credit.

- First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment.

- Purchase Returns are the goods returned by the company to the seller or creditors.

- It represents the amount that has been paid but has not yet expired as of the balance sheet date.

- A. Amounts owed from the customer is accounts receivable.

The homeowner purchased all of the building materials. Miscellaneous Expense (Account No. 568), with a balance of $ 3,200, was omitted from the trial balance. A debit of $ 16,000 for a semiannual dividend was posted as a credit to the Capital Stock account. A credit of $ 4,800 to Accounts Receivable in the journal was not posted to the ledger account at all. 13 Cash collections from customers on account, $ 36,000.

Examples of Journal Entries with a PDF

Jan. 1 The company received $ 560,000 cash and $ 240,000 of office furniture in exchange for $ 800,000 of capital stock. Exercise D For each of the following unrelated transactions, give the journal entry to record the transaction. Then show how the journal entry would be posted to T-accounts. You need not include explanations or account numbers. A current asset representing the cost of supplies on hand at a point in time.

The journal book must record every business transaction, which means entries need to be made. In accounting lingo, this is called a journal entry. We will provide you with 20 frequently asked journal entry examples on Google along with their logic. A. The only time a company provides to the customer (revenue) and uses up an asset (expense) is when the company provides goods to the customer. Sales (revenue) and cost of goods sold (expense) are recorded in the same transaction.

In this case, the proprietor may be charged interest at a fixed rate. Step 1 – At the time of providing interest to the partner via his/her capital account. Example Part 1 – Received 2,000 rent advance in Dec for next month. Step 2 – Adjusting entry when the income is actually realized. The term “prepaid expenses” refers to expenses that are paid before the actual due date.

Less cash and less owed occurs when amounts are paid. Record journal entries for each of the following transactions. The beginning balance of cash and common stock is $50,000 each.

The services will be performed in April. 9 Paid $ 2,200 for supplies received and used in March. You is sales tax an expense or a liability should be getting the hang of it by now. If not, then you can always go back to the examples above.

Apr. 1 Cash of $ 500,000 was received for capital stock issued to the owners. Aug. 1 Received cash for capital stock issued to owners, $ 400,000. 24 Collected an additional $ 6,000 from customers on account. 10 Equipment was purchased for $ 50,000; a note was given, to be paid in 30 days.